This is the first in a series of posts looking at the confiscation experience of the 1930s.

Today’s topic is vital for many people.

Confiscation is a big word that has come to mean; stealing your physical bars but done by the government so it is legal.

In the world of physical metals confiscation has become a cautionary word used by companies selling a solution to the perceived threat that governments will steal physical metals once again.

On the surface, this idea seems plausible since the story often gets slanted to say that the U.S., thought of as the economically freest country of the 1930s stole gold from its citizens.

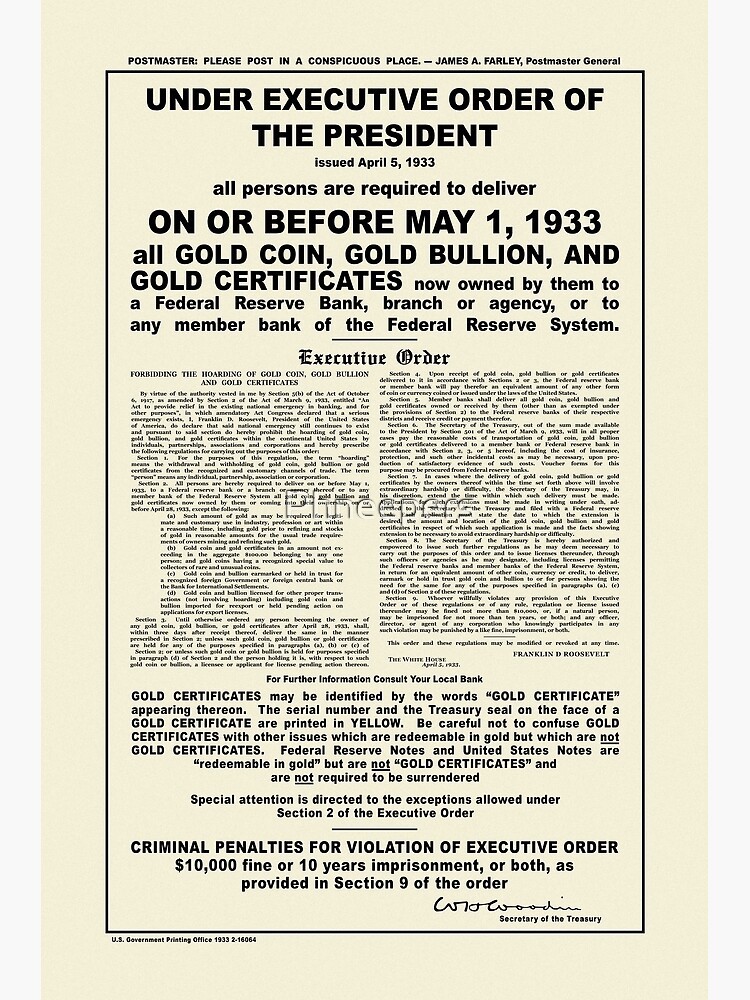

The U.S. government carried this out through Executive Order 6102 signed by the President – all persons were required to turn in their gold in exchange for dollars.

Executive Order 6102

So, what really happened in 1933 and could it happen again?

Answers to those two questions will play out in posts over the coming weeks since the subject is so complex.

Yet in short, we can say what happened is that four years after the single worst banking crisis ever experienced by the U.S., the government was still trying to reliquefy the banking system.

But counterparty risk was still a big perception problem amongst bank depositors making progress slow.

As you know banking is about collective confidence because without that confidence in the system no one will make and leave deposits in a bank.

The first important point is that the U.S. government didn’t ‘steal’ anyone’s gold.

Download Your Free Guide

The government and banks did pay cash right away for all the gold turned in by depositors.

Yes, it is true that later the price of gold was reset at a higher price, but no ounces were stolen.

The second important point is that this Executive Order was only in the U.S. It did not apply to non-US citizens and other countries did not issue such orders.

The third was that although penalties existed for not abiding, reportedly only one person was charged for hoarding gold and that charge was then overturned when the Executive Order was deemed to be not valid.

Why is Money Today Not Backed by Gold?

One big difference between 1933 and today is that gold is not money for banks today.

And it’s obvious that any government trying to reliquefy their banking system would care not a whit about calling in gold since

A) Almost no one has any and

B) It’s not helpful to banks (explained below).

Politics drove the Executive Order and supported the legislation.

Franklin Delano Roosevelt was the American President in 1933, who had been elected years earlier to end the Great Depression.

Success had come slowly since the legislation he wanted to be passed was taking a very long time.

In fact, the effort to restart the banking system can be found in the very name of legislation passed by politicians.

The March 1933 law was called “An ACT to provide relief in the existing said national emergency in banking, and for other purposes”.

What the Executive Order did was prohibit the hoarding of gold coins, gold bullion, and gold certificates.

Gold Price Today

Watch Gareth Soloway Only on GoldCore TV

Silver was not mentioned because silver was not money in the US during 1933.

Hoarding was defined by the Act as pulling gold out of the banking system in an amount greater than US$100 unless the holder had an exemption.

The Executive Order stated that gold inside the system was redeemed for US$20.67 or converted into certificates of gold redeemable later into U.S. dollars but not ounces of gold.

The US$100 limit was roughly 5 ounces of gold.

At today’s prices, the same dollar amount is nearly US$10,000.

The nearly 5-ounce limits were applied per person which meant that a family of four could hold almost 20 ounces of gold.

Expressed this way readers can begin to understand that Roosevelt hoped for preventing the one percent of rich people in America from delaying the rebuild of banking confidence that was needed to gain confidence with the other ninety-nine percent of Americans.

The ‘us versus them’ aspect of the legislation was visible later when four Republicans on the US Supreme Court wrote dissenting opinions about legality.

Gold was not criminalized.

It is critical to understand gold as legal money in 1933 but is not today. People in 1933 were keeping gold money outside the banking system because no one wanted to ‘go first’ at trusting the banking system following 5 years of collapses.

Expressed in today’s language the law said…

don’t remove more than 5 ounces if you fear a bank panic is coming because the bank needs that gold to prevent the panic.

Preventing bank panics is always in the public interest from the perspective of governments.

Why the US Dollar is Doomed

Watch Lynette Zang Only on GoldCore TV

And since gold today plays zero roles in banking panics governments have no reason to confiscate gold for this reason again.

An analogy today that puts the negativity around hoarding then in context is to think about hedge funds today trying to collapse a single stock by naked shorting that stock.

Pulling all the gold out of an otherwise healthy bank in 1933 was like a hedge fund’s ability to short stock today since both were non-confidence claims in the system that also erode other people’s confidence in that stock (or in 1933 the bank).

From the paragraphs above readers can already see that 1933 was a defensive move by the U.S. government designed to reliquefy banks and reinstall confidence in a banking system that had already been in crisis for half a decade.

The 1933 law was designed and passed to assist with the success of the government’s other actions to bail out the good actors inside the banking system at the expense of bad actors.

The Evolution of Banking Over Time

The banking system is very different today than in 1933.

In 1933 America had tens of thousands of individual banks almost all were tiny operators having a single branch. However, today there are less than a hundred global banks serving nearly the entire globe using technology instead of branches.

Today’s banks have deposit insurance which did not exist in America before FDR.

Those who fail to learn from history are doomed to repeat it.

So, what can we learn about history with respect to future confiscation? Well, that question points us toward asking … could it happen again?

The single-word answer is no. A full answer will be discussed in future posts. For now, let’s discuss just one small corner of that answer.

Bank bailouts look very different in today’s world. The 2007-12 Great Financial Crisis was an event of financial calamity not seen since the banking troubles of the early 1930s.

Massive government printing that went on then did not require gold to happen. Governments did not and will not confiscate gold to be held by the banking system.

Furthermore, following the great financial crisis of 2007-2012 politicians got the message – voters now refuse to pay for the next collapse of banks caused by greedy decisions made by those same bankers.

Legislation passed in the USA, UK, and EU requires banks all to keep a living will.

This will determine who must contribute what should the bank become insolvent.

Globally enforced regulation keeps bankers’ risk-taking with depositors’ money in check.

Governments will not use taxpayer gold or taxpayer money to bail out bad decisions. Bail-ins are the new bail-outs.

What are COCO bonds?

An entirely new class of securities has been invented to prepay for the next banking crisis named COCO bonds.

The full name is Contingent Convertible Bonds. Some jurisdictions call COCO bonds by the name Enhanced Capital Note or ECN.

A COCO bond automatically converts into the equity of the bank during a crisis.

COCO bonds pay higher yields as compensation for underwriting the risk of being converted into bank equity during a crisis.

Future posts on this topic will tackle other important aspects of this subject such as numismatic coins, exemptions to the 1933 law, and ETFs versus physical metals.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

30-03-2022 1917.80 1933.85 1458.30 1468.57 1719.12 1732.73

29-03-2022 1911.05 1910.00 1460.23 1453.89 1733.51 1717.09

28-03-2022 1927.00 1937.05 1467.41 1481.26 1754.34 1766.40

25-03-2022 1956.65 1953.80 1484.90 1479.61 1777.81 1773.66

24-03-2022 1945.90 1965.20 1475.58 1489.62 1771.55 1787.55

23-03-2022 1932.15 1931.75 1461.09 1463.69 1756.32 1759.63

22-03-2022 1929.35 1915.25 1461.48 1445.44 1753.97 1735.98

21-03-2022 1925.05 1935.05 1464.96 1465.61 1742.17 1751.80

18-03-2022 1932.90 1935.80 1470.74 1471.60 1749.27 1754.42

17-03-2022 1941.40 1949.65 1473.13 1485.63 1759.10 1759.17

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here